The Financial Services Procurement Landscape

The global financial services procurement market has reached $7.2 billion,1 driven by the sector's insatiable demand for technology, consulting, and operational services. Financial institutions — banks, insurance companies, asset managers, and payment providers — are among the most sophisticated buyers in any industry, and their procurement processes reflect this complexity.

IT spending in the financial sector alone stands at $694 billion globally,2 with a significant portion sourced through formal tender and RFP processes. For the thousands of technology vendors, consulting firms, system integrators, and service providers competing for this business, the ability to understand and respond to financial services procurement documents quickly and accurately is a critical differentiator.

The Document Challenge in Financial Services Procurement

Financial services RFPs are notoriously complex. A typical banking RFP ranges from 150 to 400 pages,3 encompassing detailed technical specifications, security questionnaires, regulatory compliance requirements, commercial terms, and multi-layered evaluation criteria. These documents demand expertise across technology, regulation, risk management, and commercial strategy — a combination that makes them exceptionally time-consuming to analyze.

The complexity is compounded by the regulatory environment. The Digital Operational Resilience Act (DORA), effective since January 2025,4 has added extensive new requirements around ICT risk management and third-party oversight that appear throughout procurement documents. Financial institutions must ensure their suppliers can demonstrate resilience capabilities, and this translates into pages of detailed requirements in every tender.

Additionally, frameworks such as MaRisk, BAIT, and BaFin outsourcing guidelines 5 create layer upon layer of compliance language that bidders must navigate carefully. A single missed requirement in a security questionnaire or a misunderstood evaluation criterion can mean the difference between advancing to the next round and immediate elimination.

Why Document Analysis Matters in Financial Services

The stakes in financial services bidding are extraordinarily high. Contract values frequently reach tens of millions of euros, competitive fields are crowded with well-resourced firms, and the evaluation processes are rigorously structured. In this environment, the quality of document understanding directly determines bid quality.

Research shows that 64% of organizations in procurement-intensive sectors struggle with communication delays during the bid process,6 and supplier onboarding timelines stretch to 15–28 days 7 — time pressure that begins with the initial document review phase. When a 350-page RFP lands on a bid manager's desk with a four-week response deadline, every day spent on document analysis is a day not spent on developing compelling technical solutions or competitive pricing.

Consider what a typical financial services RFP requires a bid team to extract and understand:

- Technical requirements: Infrastructure specifications, integration requirements, API standards, data migration needs — often described in granular detail across multiple volumes.

- Security requirements: Encryption standards, access controls, penetration testing expectations, incident response capabilities, data residency mandates — frequently presented as exhaustive questionnaires with hundreds of individual items.

- Regulatory compliance: References to DORA, MaRisk, BAIT, GDPR, PSD2, and sector-specific regulations — scattered throughout the document and requiring careful cross-referencing.

- Evaluation criteria: Multi-stage evaluation processes with weighted criteria, scoring methodologies, and presentation requirements — understanding these is essential for bid strategy.

- Commercial terms: Pricing models, SLA frameworks, penalty regimes, liability structures, insurance requirements — each with significant financial implications.

- Transition and implementation: Migration timelines, parallel running periods, knowledge transfer requirements, project governance structures.

Manual review of a complex banking RFP typically consumes three to five working days of senior staff time — and even then, the risk of overlooking a critical requirement buried on page 287 remains real.

The AI Revolution in Financial Services

The financial services sector is rapidly embracing artificial intelligence. Research indicates that 82% of financial services organizations plan to use AI agents by 2027,8 and 38% of Fortune 500 companies — many of them financial institutions — are already incorporating advanced analytics into their vendor evaluation processes.9

This AI adoption extends naturally to the procurement document analysis process. For service providers responding to financial services tenders, AI-powered document analysis is no longer a nice-to-have — it is becoming essential to compete effectively against firms that have already adopted these tools.

How Everwise Transforms Financial Services Tender Analysis

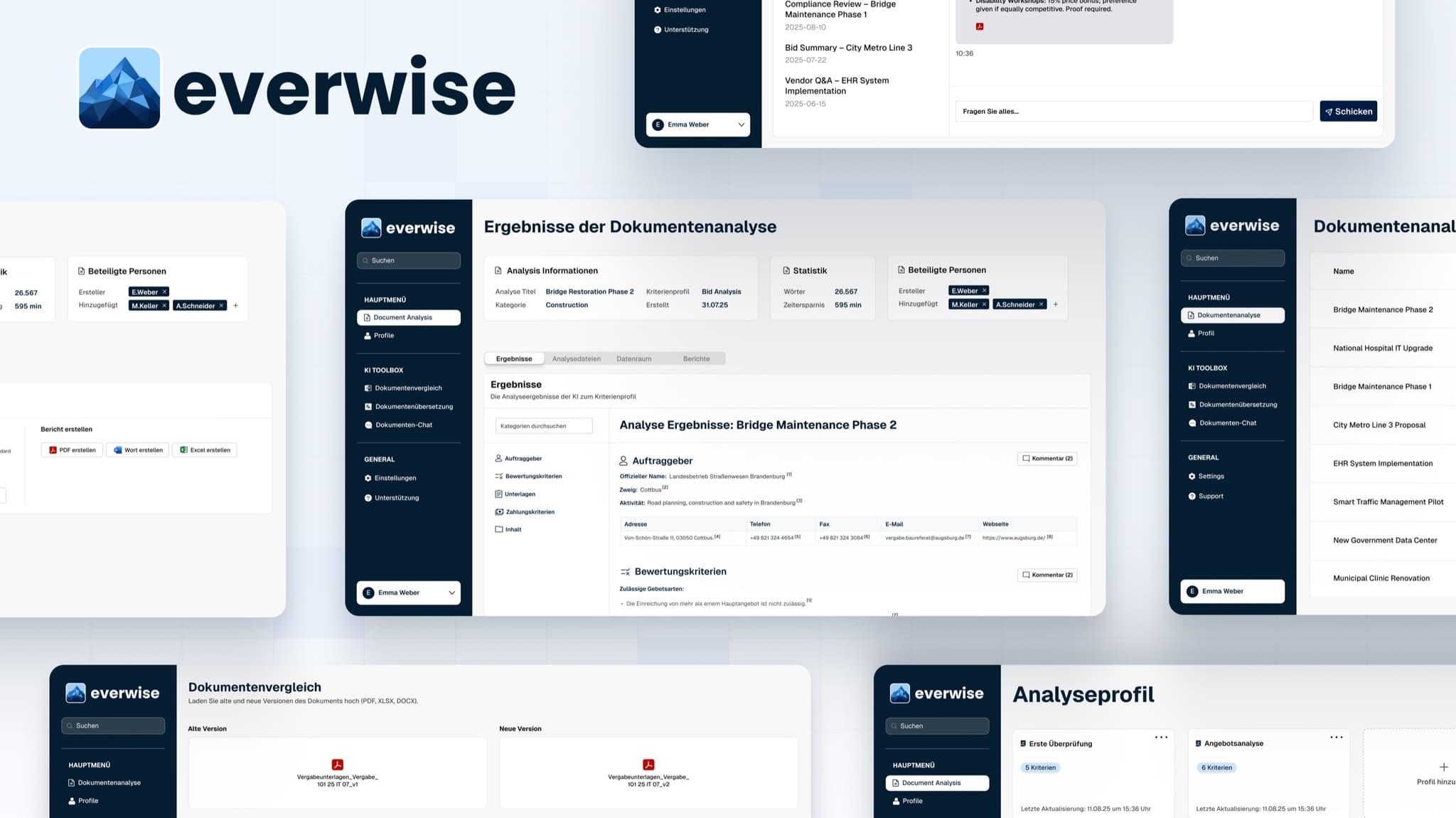

Everwise is an AI-powered document analysis platform that fundamentally changes how organizations engage with complex financial services procurement documents. It is designed for the specific challenges of financial RFPs: dense regulatory language, extensive security questionnaires, and intricate evaluation frameworks.

Deep Document Analysis

Upload your financial services RFP — whether it is a PDF, Word document, or multi-file tender package — and Everwise's AI engine analyzes the entire content automatically. The system extracts and structures requirements, evaluation criteria, deadlines, compliance stipulations, and commercial terms, transforming hundreds of pages of dense text into organized, actionable intelligence.

With customizable analysis profiles offering unlimited criteria, you can configure the AI to focus on what matters most for your specific response. A cybersecurity vendor can prioritize security requirements; a consulting firm can focus on evaluation methodology and team qualification criteria; a technology provider can emphasize integration and migration requirements.

Chat with Financial RFPs

Everwise's conversational interface is particularly powerful for financial services documents. Ask natural language questions and receive instant, source-referenced answers:

- "What are all the data residency requirements in this RFP?"

- "Summarize the evaluation criteria and their weightings."

- "What penetration testing requirements does the security questionnaire specify?"

- "What are the SLA targets for system availability and incident response?"

- "Which regulatory frameworks are referenced in the compliance section?"

Every answer comes with precise page and section references, allowing your compliance team, technical architects, and commercial leads to verify information instantly without searching through hundreds of pages independently. This capability is transformative when multiple team members need to access specific portions of a complex RFP simultaneously.

Amendment Tracking Through Document Comparison

Financial institutions frequently issue clarifications, amendments, and revised document versions during the tender period. These changes can modify critical requirements — adjusted SLA targets, revised security standards, updated evaluation weightings, or altered commercial terms.

Everwise's document comparison feature identifies exactly what changed between document versions, presenting a clear, structured summary of all modifications. For a 400-page banking RFP where the second version contains subtle but significant changes to security requirements, this capability alone can prevent a costly oversight.

Multilingual Document Processing

For firms operating across European markets, financial services tenders frequently arrive in multiple languages. Everwise's translation capabilities allow you to process tender documents across language barriers while maintaining the precision that financial and regulatory terminology demands.

Professional Corporate Design Reports

Export structured analysis results to PDF or Excel in your corporate design. These reports support bid/no-bid decision meetings, internal compliance reviews, and team briefing sessions. A standardized analysis output ensures that every stakeholder — from the bid manager to the chief risk officer — works from the same comprehensive understanding of what the tender requires.

The Competitive Impact of AI-Powered Document Analysis

In financial services procurement, where contract values are high and evaluation processes are rigorous, the quality of your document understanding directly impacts your win probability. Firms using AI-powered document analysis gain measurable advantages:

- Faster bid/no-bid decisions: Key requirements and evaluation criteria extracted in minutes rather than days allow leadership to allocate resources to the most promising opportunities earlier.

- More comprehensive compliance: AI analysis surfaces every requirement across every page, reducing the risk of incomplete responses to security questionnaires or missed regulatory stipulations.

- Better team coordination: When your technical team, compliance function, and commercial leads all have structured access to the same document intelligence, response quality improves across every section.

- More strategic responses: Time saved on document reading is time invested in developing differentiated technical solutions, competitive pricing, and compelling win themes.

Security Built for Financial Services Standards

Everwise processes your tender documents with security standards appropriate for the financial services sector. All documents are encrypted with 256-bit AES encryption, hosted exclusively in Germany, and handled in full GDPR compliance. Your documents are never used for AI model training, ensuring that your bid strategies, pricing approaches, and competitive intelligence remain completely confidential.

Preparing for the Future of Financial Services Procurement

As financial institutions continue to increase the complexity and rigor of their procurement processes — driven by DORA requirements,4 evolving BaFin guidelines,5 and growing ESG expectations 9 — the volume and density of tender documentation will only increase. The firms that will win in this environment are those that can process more RFPs, more accurately, in less time.

Everwise provides the document intelligence foundation that modern financial services bidding demands. By transforming how your team analyzes, understands, and extracts information from complex RFPs, it lets your subject matter experts focus on what they do best: crafting winning proposals.